The Adaptive Personalization Gap: Why It’s Needed in 2026

Shopping isn’t as simple as it used to be. Long gone are the days where we had the patience to drive to the mall, walk into a store, and wait in tedious lines to try on a pair of boots or test out a pair of headphones. Thankfully, this is where adaptive personalization can align with our modernized way of shopping.

In 2026, customers are more unpredictable than ever – with up to 70% of online shoppers abandoning their cart before even making it to checkout.

As a whopping 90% of human decisions are emotionally driven, it’s not surprising that a digital shopper’s intent is subject to change on a dime – especially in today’s short-attention-span world. This reveals why adapting quickly to single-session activities is essential for success.

Therefore, the challenge with these less-than-analytic shoppers is that most brands have to invest in personalization. However, even then, many brands can still fall short on what makes for a truly successful personalization strategy.

Take a look at just a few of the “micro-moments” that matter and are often still missing in many approaches to personalization today:

Low Battery

A user with low battery may not have enough time to finish their session, creating urgency to convert them quickly.

Private Browsing

Incognito mode hides user history, making it harder to personalize based on past data. In-session behavior becomes critical.

Multiple Tabs Open

A user with many tabs may be comparison shopping or get distracted. Grab their attention before they click away.

Color Preferences

Users often show affinity for certain colors in products. Adapting image results to match these preferences can boost engagement.

Shopping Extensions

The presence of coupon extensions signals a price-sensitive shopper who may be receptive to a targeted discount.

Zoomed Images

When a user zooms in on product images, it indicates high interest. This is a key moment to provide more detail or social proof.

The Problem with the “Unknown”

In the midst of the rise of digital shopping and consumption, up to 90% of website traffic is anonymous, incognito, or logged out – which deems more traditional data-reliant personalization strategies less effective.

In order to seize the opportunity at hand when a user reaches your site, brands have to take bold ideas and turn them into action. To that end, an effective transition from static to real-time, adaptive personalization strategies can make a world of difference.

Quick Recap: What is Personalization?

In simple terms, personalization refers to the process of tailoring an experience according to the individual user’s preferences as an effort to encourage deeper and more methodical on-screen time to boost conversation rates. As a whole, the main goal of personalization is to leverage tactics that will increase the chances of a user making a purchase on the website.

Deploying an effective personalization strategy isn’t always easy, as brands need to have a good understanding of their customers. This requires collecting various demographic information such as age, gender, and location. As a result, this data can help brands to create a better digital experience for each individual user.

Real-World Example of Personalization

Imagine someone going to a popular fashion apparel store. Oftentimes, the main demographic for these websites may involve women in their teens or 20s living in warm climates – meaning it might recommend something more fitting to their local temperature such as a lightweight jacket or capri pants that it may not share with a user living in Canada.

As a result, personalization can also use predictive strategies, most commonly algorithms in order to further shape and refine the shopper’s digital experience.

For instance, customers who have previously purchased boots, sunglasses, or necklaces may be recommended the same products upon returning to the site — or even within the same session — based on the assumption that they are interested in that type of apparel.

What is Real-Time Personalization?

Real-time personalization refers to the type of personalization that occurs simultaneously as a consumer digitally explores a shopping site.

The name “real-time” personalization comes from the instantaneous element of the experience: as the processing, analysis, and utilization of collected data happens on the fly – allowing brands to adjust the user experience accordingly while they’re still shopping.

Especially as we dive deeper into the era of immediate gratification, such as how Gen Z shoppers are migrating their shopping habits toward PDPs instead of a traditional Google search – it’s becoming increasingly imperative to implement these types of instantaneous personalization techniques.

Some examples of real-time personalization and how they could benefit your brand long-term include:

How Real-Time Personalization Benefits Your Business

Real-Time Intent Detection

What it is

Real-time intent detection analyzes in-session behavioral signals — such as scroll depth, click patterns, and time spent on specific product pages — to predict what a visitor is looking for before they even search for it.

How it drives long-term revenue

By surfacing the most relevant content, products, or offers at the exact moment a user shows intent, brands can dramatically reduce drop-off rates and shorten the path to purchase. Over time, this builds a self-reinforcing loop: more conversions generate more behavioral data, which in turn fuels even more precise personalization — compounding revenue gains with every session.

Revenue Impact: Reduced drop-off + Higher AOV

Intelligent Incentive Targeting

What it is

Not every visitor needs a discount to convert. Intelligent incentive targeting uses real-time behavioral scoring to identify which users are already likely to purchase — and withholds discounts from them, while serving timely promotions only to those showing hesitation signals.

How it drives long-term revenue.

This tactic protects your profit margins while still recovering at-risk sessions. Instead of training your entire audience to wait for a coupon, you reward undecided shoppers at the right moment — increasing conversion without eroding the perceived value of your brand. The result is a healthier revenue baseline that grows sustainably.

Revenue Impact: Margin protection + Smarter discounting

Adaptive Product Discovery

What it is

Adaptive product discovery dynamically reorders carousels, category pages, and search results based on inferred preferences detected during a live session — such as color affinity, price range sensitivity, or brand loyalty signals — without relying on cookies or login data.

How it drives long-term revenue

When users consistently find what they are looking for faster, satisfaction scores rise and repeat visit rates follow. Brands that implement adaptive discovery typically see a measurable uplift in both revenue per visitor and return purchase frequency — two of the most reliable long-term revenue indicators in e-commerce.

Revenue Impact: Higher RPV + Increased retention

Cookieless Personalization For Anonymous Users

What it is

Up to 90% of website traffic is anonymous — users who are not logged in, browsing in incognito mode, or who have cleared their cookies. Cookieless personalization leverages purely in-session micro-behaviors to build a live picture of user intent, requiring no historical data or PII whatsoever.

How it drives long-term revenue

This approach future-proofs your personalization strategy against ongoing privacy regulation changes (GDPR, CCPA) and browser-level cookie restrictions. By unlocking a personalized experience for the majority of your traffic that was previously treated as generic, brands unlock an entirely new revenue pool — one that grows more valuable as third-party data becomes increasingly scarce.

Revenue Impact: New revenue pool + Privacy-proof strategy

In the age of real-time available insights that can be used immediately to boost the chances of a consumer purchase, many brands are contemplating if it’s worth making the switch from static to adaptive personalization.

The Limits of Traditional (Static) Personalization

While there isn’t anything inherently wrong with the use of more traditional, or better known as static, personalization – brands may benefit from implementing the use of adaptive personalization strategies with software such as AdaptiveCX.

The main issue between traditional and adaptive personalization is that static personalization relies on historical data, fixed segments, and can be too slow for real-life user behavior – as it operates under the notion that user activity remains consistent and doesn’t change within milliseconds.

Furthermore, passive personalization strategies aren’t preferred by the majority of consumers – with up to 53% of users claiming these tactics made for a less-than-optimal shopping experience. As a whole, this can lead to less conversation, brand loyalty, and reduced ROI – all of which could be evaded by implementing real-time personalization.

The battle cards below will further break down the differences between “real-time”(adaptive) and “non-real-time” (static) personalization:

Real-Time Personalization

⚡ Milliseconds — during the live session- Adapts to user behavior as it happens — clicks, scrolls, pauses, and tab switches all inform the experience in real time.

- Triggers timely pop-ups, messages, and product changes while the user is actively shopping — not hours later.

- Maintains consumer interest and momentum on-site, reducing the likelihood of drop-off or distraction.

- More intuitive and user-friendly — helps visitors find what they are looking for without friction.

- Maximizes revenue opportunities at the peak of buying intent, when the user is most likely to convert.

- Works for anonymous, cookieless, and incognito users — no historical data required.

Personalization that acts in the moment, not after it. The difference between a sale and a missed opportunity is measured in milliseconds.

Standard Personalization

🕐 Hours, days, or weeks — after the session ends- Personalization occurs outside the direct session — often long after the user has already left the site.

- Relies on historical data, past purchases, and cookies to build audience segments over time.

- Retargeting emails and ads may reach the user days or weeks after their original intent has faded.

- Has less immediate impact on the user experience during the moment that matters most — the visit itself.

- Cannot account for in-session context shifts, such as a change in intent or urgency signals like low battery.

- Dependent on known user data, making it ineffective for the ~90% of anonymous visitors.

Personalization that arrives too late. By the time the message reaches the user, the buying window has already closed.

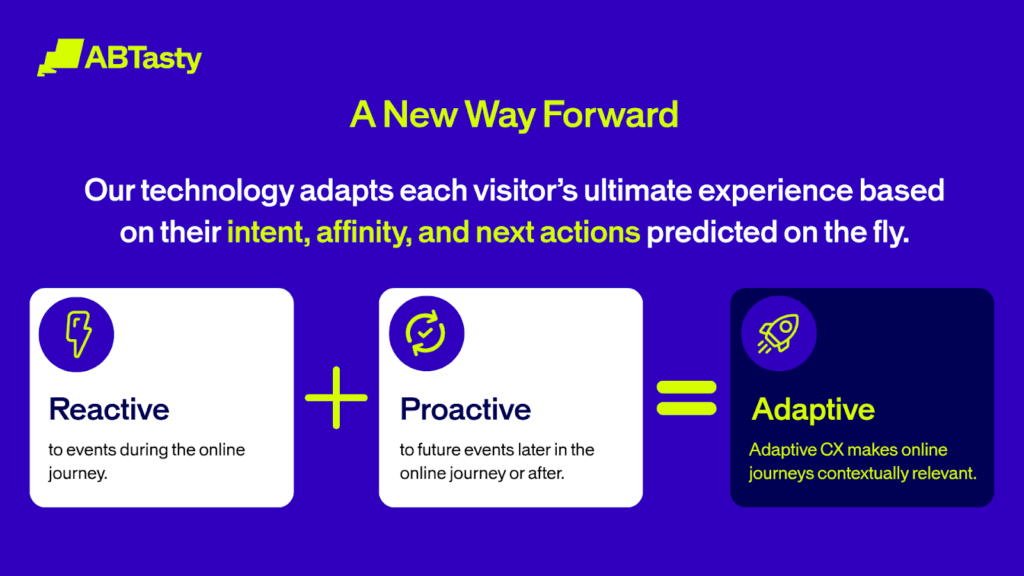

Enter AdaptiveCX: Real-Time Personalization for Everyone

What is AdaptiveCX?

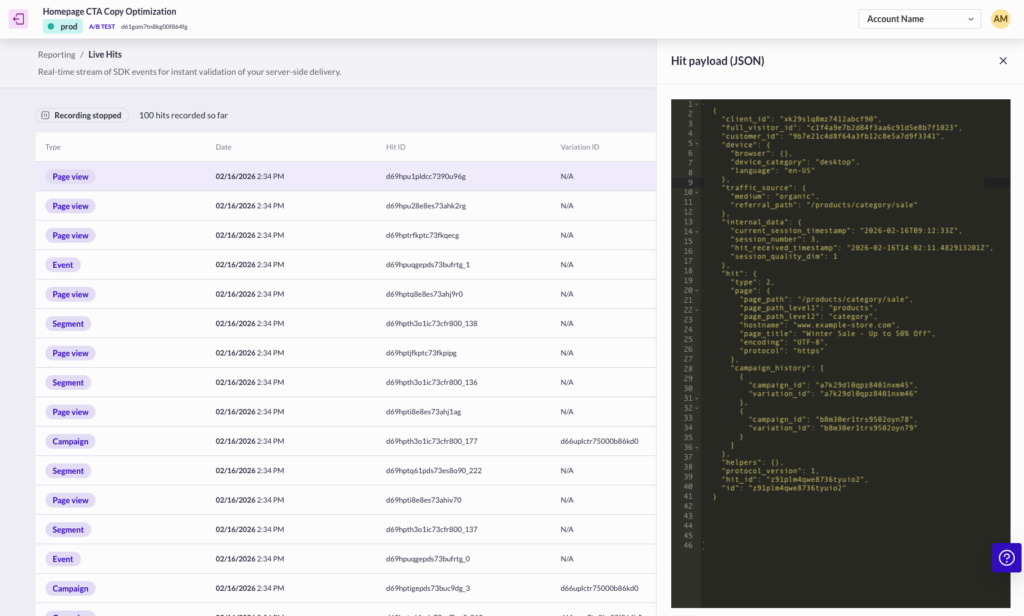

AdaptiveCX is a predictive AI engine that processes behavioral signals while the user is still in session. This can help to better understand visitor intent and adapt their digital journey on the spot. Ultimately, this can help to boost revenue opportunities, as it keeps users engaged with their relevant interests and encourages stronger on-page time.

Ultimately, the goal of AdaptiveCX is to allow brands to make customer experiences more flexible and enticing to the user in real-time – as without it, websites can miss the mark on maintaining consumer interest all the way to check out.

Now used by over one billion visitors, several leading global brands utilize AdaptiveCX to ensure their personalization tactics remain instantaneously meaningful to the user at hand.

Some of the hallmark qualities of AdaptiveCX include:

Cookieless by Design

AdaptiveCX relies entirely on in-session behaviors (clicks, scroll depth, dwell time, multiple tabs) rather than historical identity or PII, making it privacy-compliant and effective for anonymous traffic – which totals at a staggering 90% of visitors.

Speed and Scale

Predictions are calculated and activated in roughly 20 milliseconds, ensuring the experience adapts instantly without slowing down the site.

Ease of Use

With AdaptiveCX, there’s no need for data scientists or engineers – as product managers, data and analytics teams, and even those working in merchandising can easily deploy this personalization without any required additional skills.

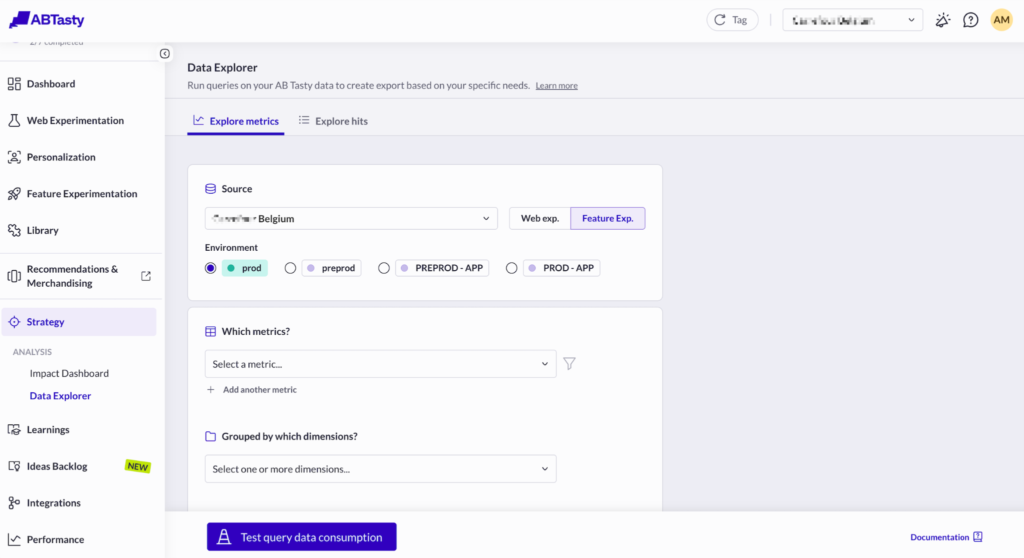

How AdaptiveCX Works in Real-Time

The horizontal timeline below will reveal how AdaptiveCX works in real-time:

Step 1

Analyzes Live Signals

Captures micro-behaviors like mouse movements, pauses, and product comparisons as they happen in the session.

Step 2

Predicts Intent Instantly

Uses AI to forecast affinities (e.g., categories, colors, brands) and the likelihood of future actions (e.g., probability to purchase, abandon, or return).

Step 3

Delivers Real-Time Results

Automatically pushes the right experience — be it a customized search result, targeted content, or a timely promotional nudge — directly to the user.

Real-World Use Cases of Real-Time Personalization with AdaptiveCX

There are several ways that AdaptiveCX helps users to seamlessly implement real-time personalization techniques. In turn, these practices can often prove worthwhile for brands over the long-run.

Here are just a few of the ways AdaptiveCX makes personalization both fearless and seamless:

- Intelligent Incentives: AdaptiveCX’s technology works by predicting user intent and connecting people with the products they are most likely to buy. This ultimately curates a more clever digital experience bound to boost sales.

- Adaptive Search: With AdaptiveCX, you can personalize search suggestions and listing pages to be filtered according to inferred preferences from the user. This drives faster discovery and higher chances of a consumer purchase.

- Adaptive Carousels: Users of AdaptiveCX can dynamically reorder categories based on user intent to ensure the most relevant items are always seen first. This includes color detection, promoting products more fitted towards potential revenue, and automatic reshuffling based on preferences.

- Personalized Pop-Ups: Various adaptive promotions and perfectly tailored pop-ups are generated on the spot. This can help to align with the user’s interests and can incentivize a shopper to stay on the site.

- Out-of-Stock Experiences: AdaptiveCX helps to avoid drop-offs by speedily showing personalized, high-affinity alternative products when an item is unavailable. As websites only have around 15 seconds before a user decides whether or not to leave the page, showing these customized replacements can help retain audience attention and engagement.

The Benefits for Businesses Becoming Adaptive

In today’s modernized world, it’s crucial to step inside the consumer’s mindset to ensure continuous business success. Luckily, adaptive personalization can be the exact, “set-it-and-forget-it” method brands can easily use to assimilate to the challenges of online shopping.

Take a look at what can be achieved without the need for heavy infrastructure or large data science teams when you use AdaptiveCX for personalization:

+10%

increase in conversion rates.

+15%

uplift in revenue per visitor.

2.5x

improvement in retention rates.

The future of customer experience (CX) will continue to align with the rest of technology today. This means it isn’t about knowing who your customers were, but understanding what they want right now.

Taking a bold step, such as from static to adaptive personalization, could be the exact kind of brave change your brand needs to unlock the next level of excellence.

Are you curious to learn more about how AB Tasty and AdaptiveCX can help you make progress in personalization?